What a Debt Warning Letter can do for you if you get into debt, is to help you through it. A debt warning letter is a legal letter that you can use to give your creditors some information about your financial situation. The information is in response to a summons that your creditors sent to you to answer a lawsuit from your creditors.

Lenders will contact you and ask you some questions that they want to know about your current and future financial status. You have 30 days to respond to the summons. If you fail to answer the summons, then you could be sued by your creditors. A Debt Warning Letter can help your creditors avoid that lawsuit.

Even if you don’t take action against them, your creditors can still go to court and try to get a judgment against you for a creditor lawsuit. A debt warning letter helps you in all of this.

A debt warning letter is different from a lawsuit. A debt warning letter doesn’t have the same legal force as a lawsuit. There is some difference between a debt warning letter and a lawsuit and the best way to tell is by asking your attorney.

A debt warning letter will be sent to your creditors with the legal name of the creditor who sent you the summons. The letter will tell them that you are the individual named in the summons and that they are being sued by the individual named in the summons. Your lawyer will need to review this letter and tell you what you can and cannot say in the letter.

You should not say anything you might regret saying in the debt warning letter. For example, don’t say anything you think could get your lawyer into trouble. Make sure your attorney has read the letter and you have also reviewed it.

A debt warning letter can help you get through any problem you face with debt. Just make sure your attorney has reviewed the letter and you have reviewed it too.

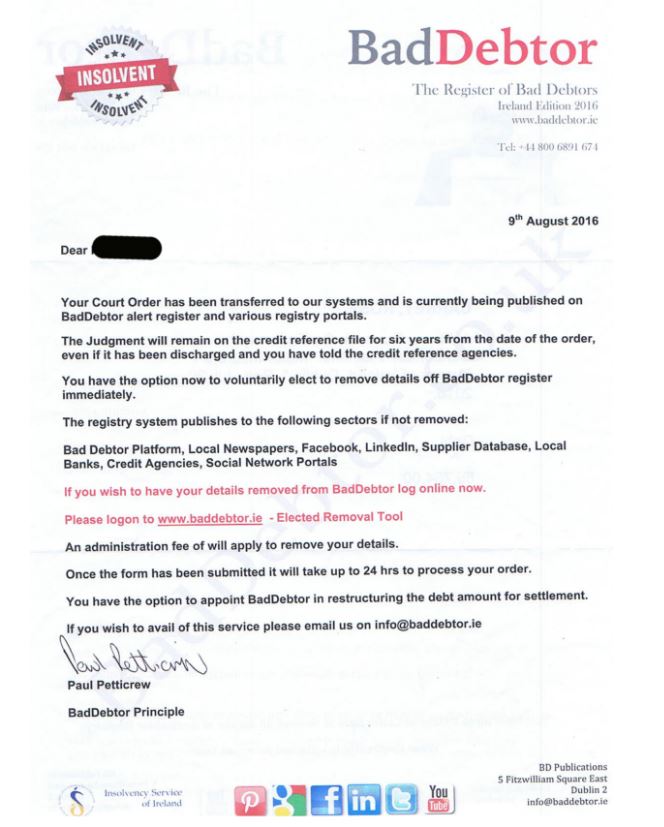

Insolvency expert issues warning about “non existent” debt

New Debt Relief scam is targeting seniors — Mississippi Consumer

Debt Collection Letter New Zealand Debt Collection

Insolvency expert issues warning about “non existent” debt

HMRC Unpaid Debt and 7 Day Winding Up Threat | Begbies Traynor

HMRC Notice Warning of Enforcement by Distraint | Can I stop

Debt Collection Letter New Zealand Debt Collection

IRS put tax debtors on warning about passport restrictions…again