In case the loan was secured by means of a vehicle was unnecessary, because it was, naturally, an auto loan. After it is paid off, you might get a different type of payoff letter confirming that your payment was received and your account is closed. If your loan is with a big lender, you ought to be in a position to visit its internet website and request your payoff amount. If you get a federal loan, you’ll discover your 10-day payoff amount in the Loan Payoff Calculations part of your account.

Make certain you understand what it will truly cost to pay back the loan and be certain you send enough to find the account closed on your very first try. If you’ve got more than 1 loan with that institution, get the Account number to produce certain you will be receiving the information for the right account. The financial loans are liabilities. The terms of the loan result in regular payments to them until it is paid off. Of course, if it’s the case that you require a personal loan for reasons apart from debt consolidation, then you will need to appear elsewhere.

Your 30-day payoff amount is going to be shown. Once you get your payoff sum, you ought to think about getting it done whenever possible. Choose the loan for which you desire to get a payoff amount. Otherwise, Payoff might be a very good fit for you. In 2015, it became the first online lender to offer its borrowers free credit scores. Your home mortgage payoff is the main instance of your life and you may do it within 4 months utilizing the United States Government’s money.

Your entire payoff sum differs from your present balance, as it includes the total amount of interest you owe through the day you mean to completely pay off your loan. If there’s a remaining balance on your loan, we will request that you pay off your servicer straight to your current servicer account is paid in full. A high student loan balance could destroy your chances of obtaining a mortgage in any respect.

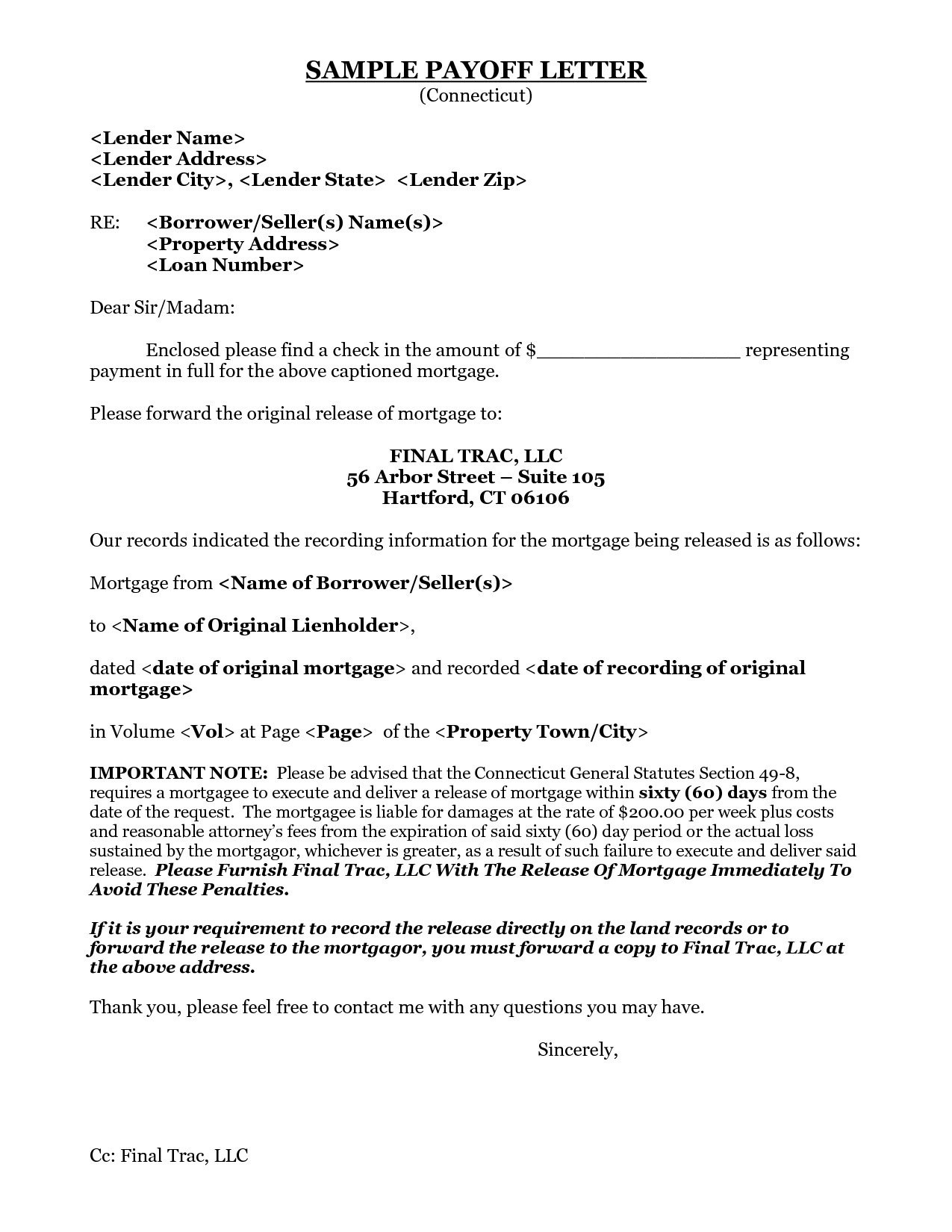

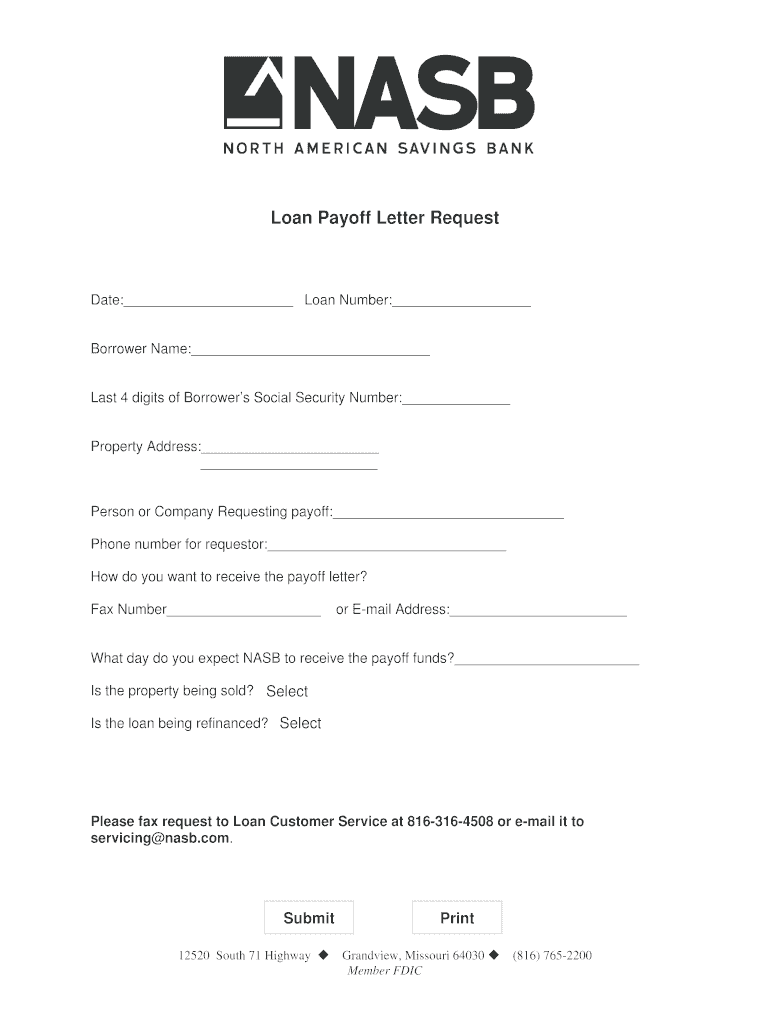

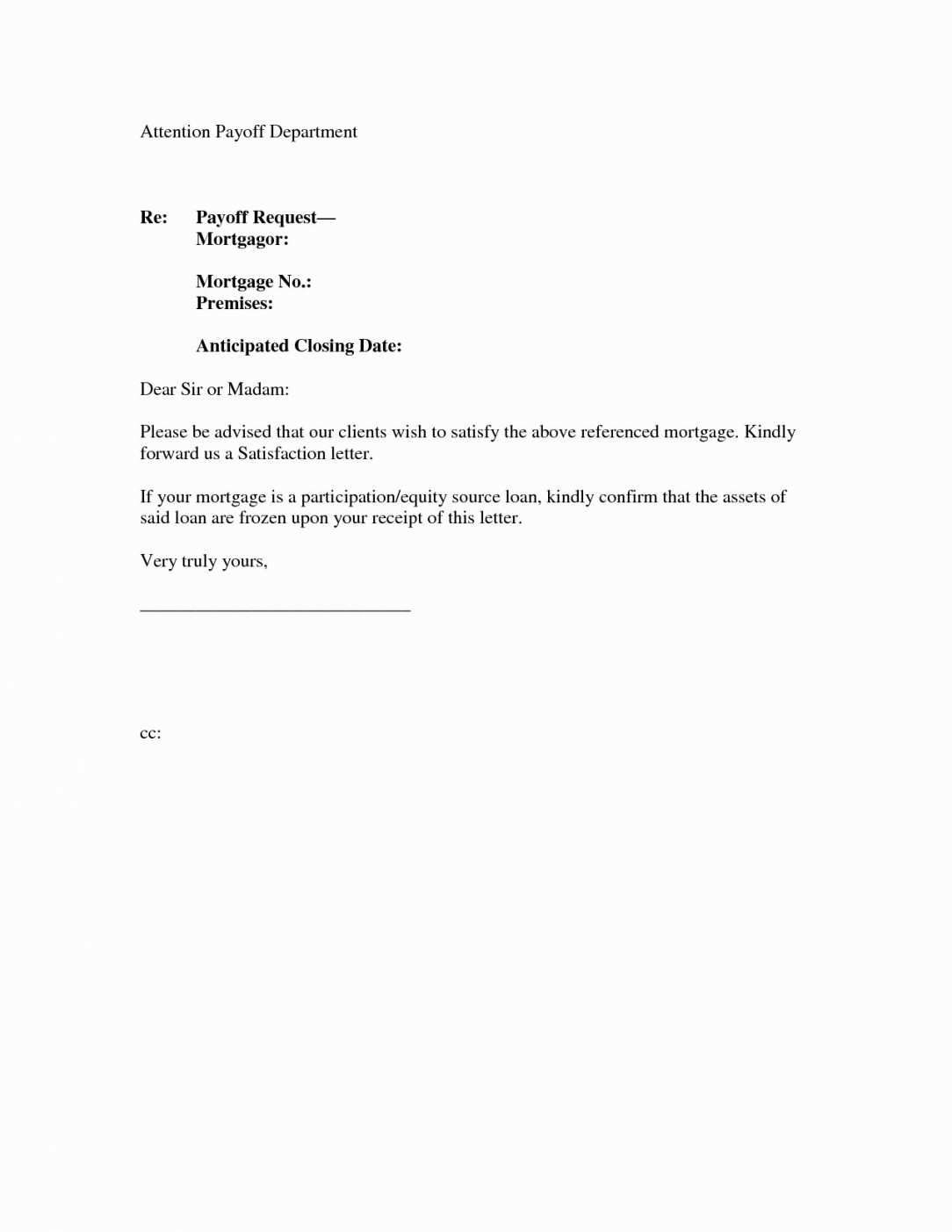

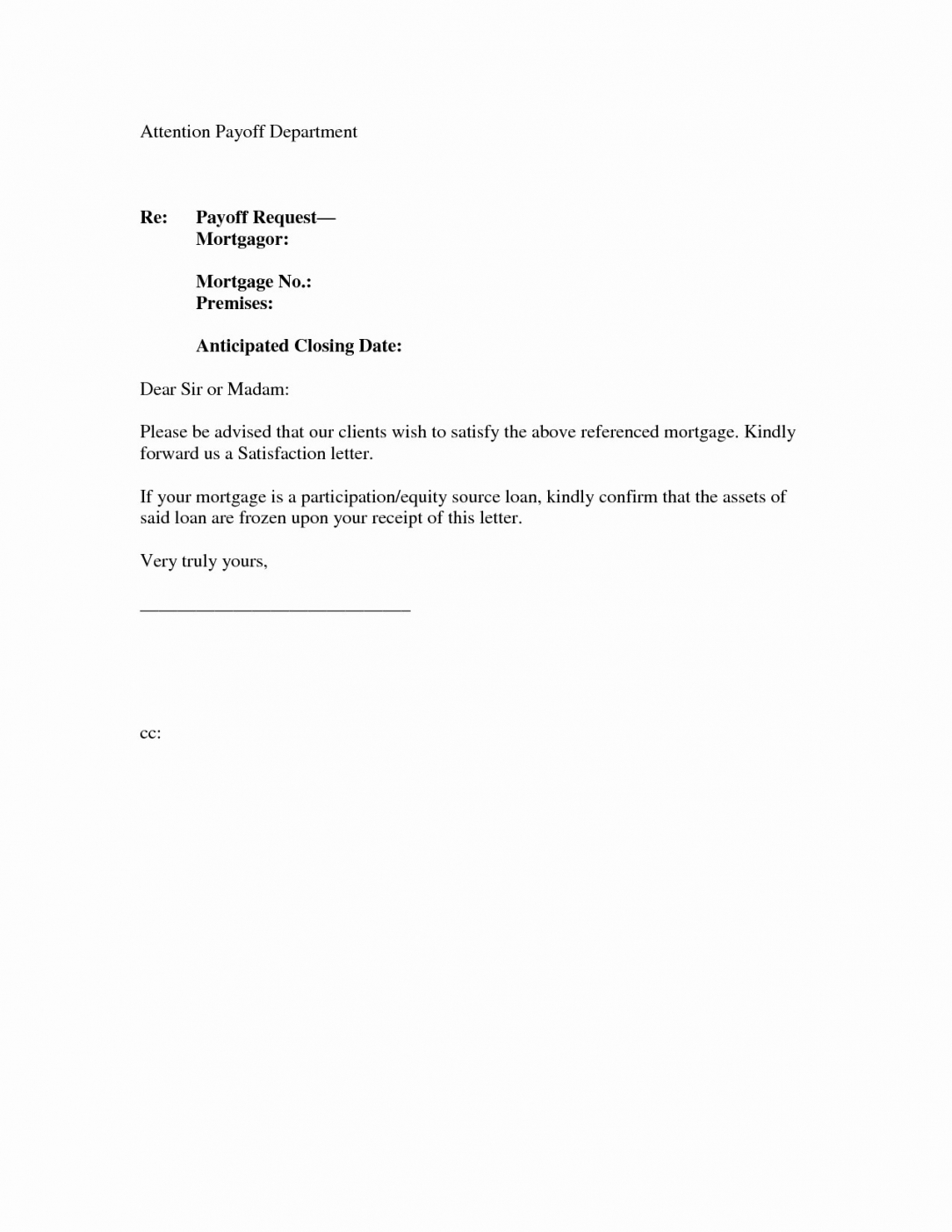

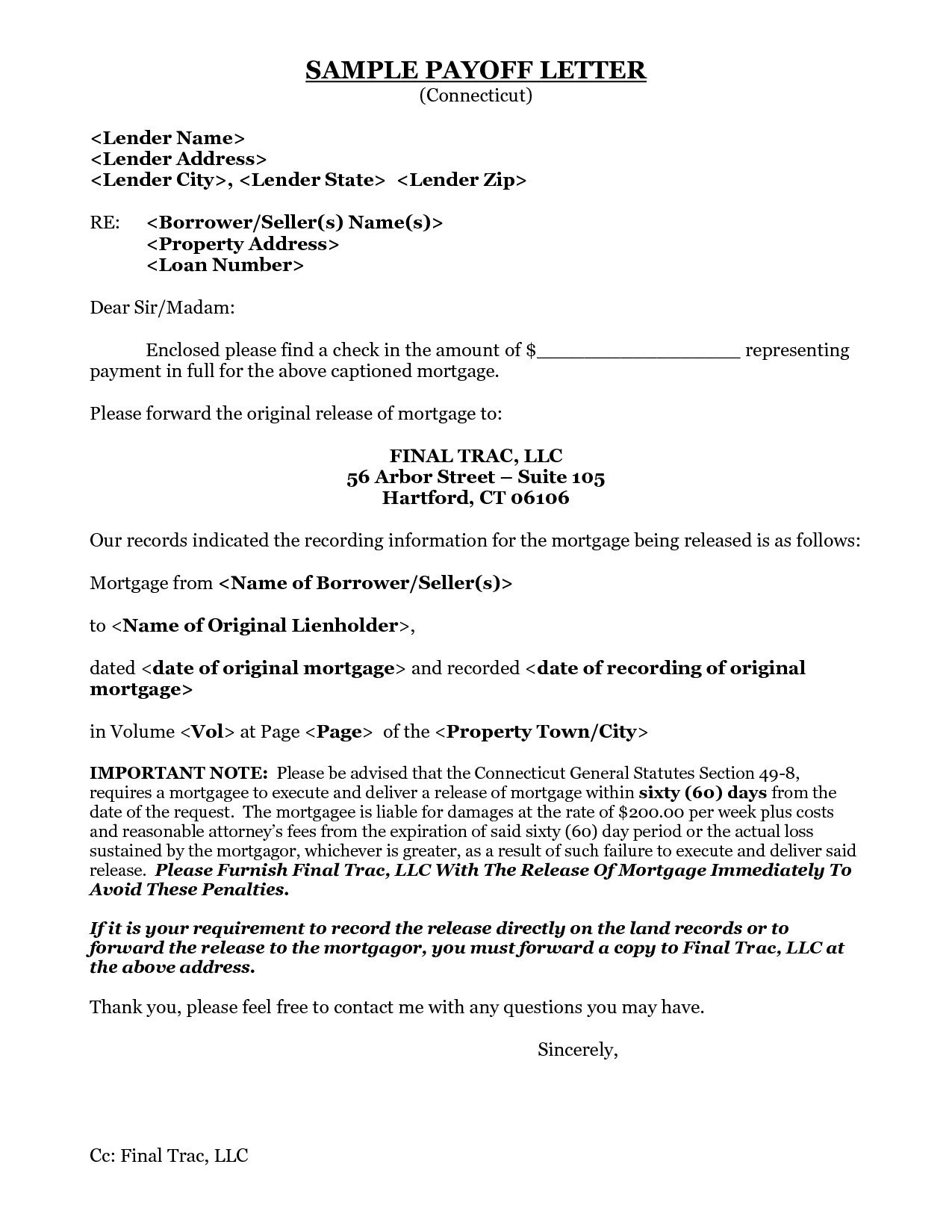

Payoff statements may be used in collection actions for all kinds of loans. Requesting a payoff statement is commonly the very first step in paying off financing. The payoff statement normally shows the remaining loan balance and number of payments along with the quantity of interest that’ll be rebated as a result of prepayment by the lendee. To make certain you pay the right quantity, you want an official payoff statement from the servicer.

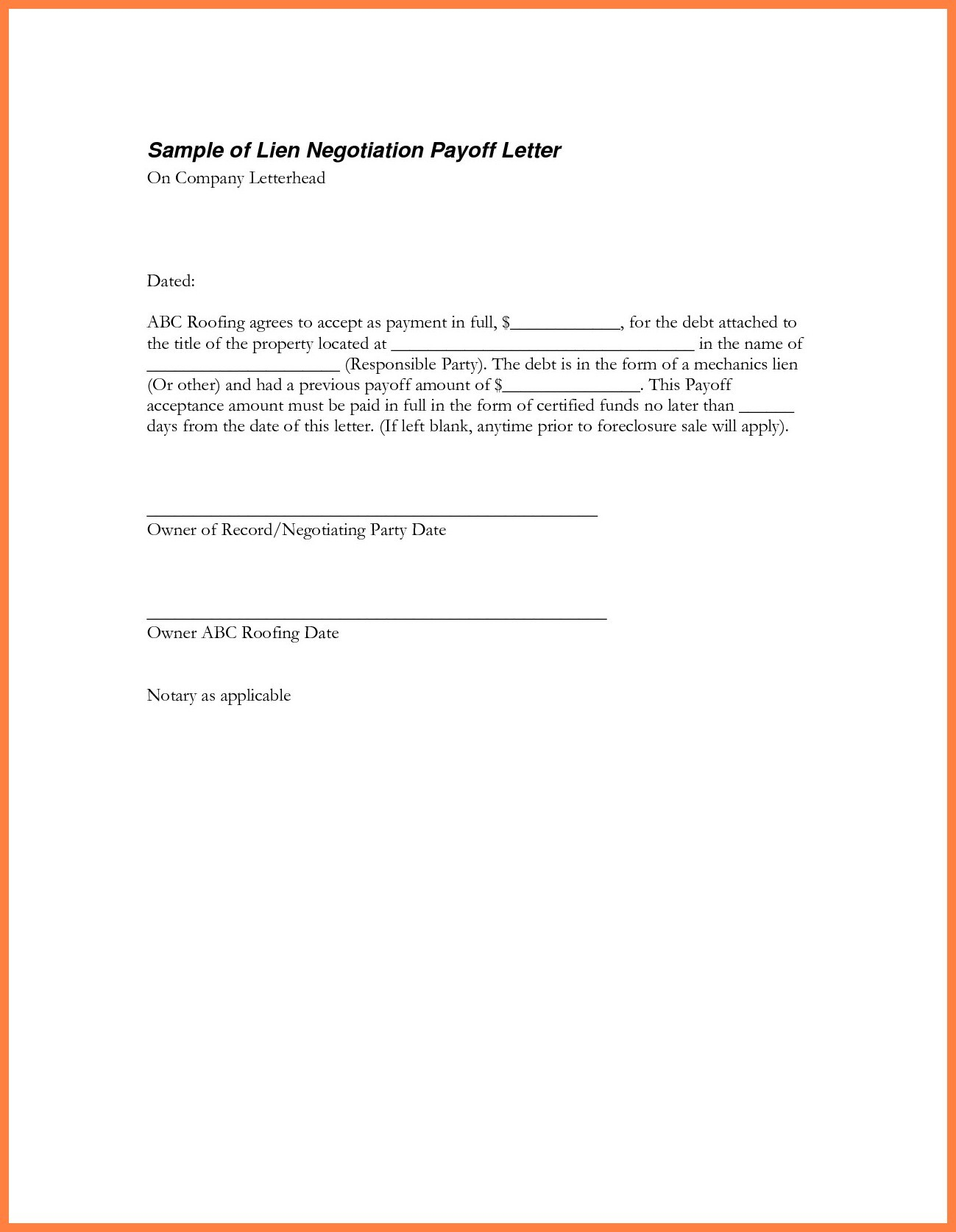

The letter lets you know exactly how much to pay by a predetermined date, and the way you should make the payment. To prevent problems, you can ask for a payoff letter, and your lender will offer an official document with instructions on how best to completely pay back the loan in 1 transaction. A payoff letter is a document that gives detailed instructions about how to pay off financing. Payoff letters may be used to protect against a foreclosure sale. Payoff letters, also called official payoff statements, help you avoid surprises by offering all the info you need in 1 place.

Payoff Letter Fill Online, Printable, Fillable, Blank | PDFfiller

Boat Loan Payoff Authorization Letter BL2 Blue Water Boat

Payoff Letter Template Fill Online, Printable, Fillable, Blank

Template Letter For Debt Repayment Valid Auto Loan Payoff Letter

Mortgage Payoff Letter Template Examples | Letter Template Collection

Printable Template Letter For Debt Repayment Valid Auto Loan

Mortgage Loan Payoff Letter Template Samples | Letter Template