Small business owners need to have a small business balance sheet so they can properly document and monitor their business’s financial health. A balance sheet shows your company s overall progress as well as identifying areas for improvement. There are usually three parts to a balanced sheet: assets, liabilities, and ownership equity. Assets represent what you personally own.

Liabilities consist of what you legally owe to others, plus the current value of any future claims you may have to pay. If you owe money to someone or a company this represents a liability. If you have equity in a business and it is worth more than what you currently owe, then it represents equity and part of your small business balance sheet.

To prepare your small business balance sheet, first determine your net worth – what you currently owe creditors, less what you currently have invested in your business. This will be a positive number if you are a young startup with very little debt. Net Worth allows you to see how much money you have invested in your company, but don’t let it exceed more than forty percent of your annual income. The other major area to track is your short-term and long-term debts. These are the obligations that come due in one year (monthly lease payments, equipment purchases, etc.) Cash flow forecasts are important to understand because they show how your company will operate based on existing cash flows.

Many small businesses struggle because they don’t always understand the importance of a balanced sheet and what it means. Most small businesses don’t have a formalized system for maintaining their balance sheets, so they either resort to using an easy to use balance sheet template or they simply forget to do it at all. Doing so can leave them vulnerable to the whims of creditors who may require them to pay off debt before they receive any money from sales. If your organization has employees, then it is imperative that they understand your policies regarding balance sheets and that they sign the appropriate forms. When you work with a third-party to maintain your balance sheets (such as a CPA), they can also make adjustments to them on a monthly basis as well as quarterly or even yearly basis. By utilizing a professional CPA to do your balance sheets, you can ensure that your business is prepared for all potential eventualities and can manage them effectively.

When you have your current balance sheet in hand, it is important that you review it for asset utilization. You need to make adjustments to your current assets in light of recent or pending expenses or revenue loss. If you have excess inventory, then you should liquidate these accounts and move some of your inventory to meet current sales demands. It may also be time to move some of your inventory to meet seasonal fluctuations such as Halloween. You may also want to make adjustments to your inventory to take advantage of seasonal increases in demand for particular merchandise.

Your current balance sheet should show a comprehensive representation of your organization’s assets and liabilities. You will want to balance your current assets with your liabilities. The purpose of this exercise is to determine both the income side of the equation as well as the total assets required to support the operating, capital, and debt responsibilities of your business. When you have a complete picture of your organization’s needs, you will be able to determine just how much debt you need to eliminate, how much operational funding you will need and how much equity you need to raise.

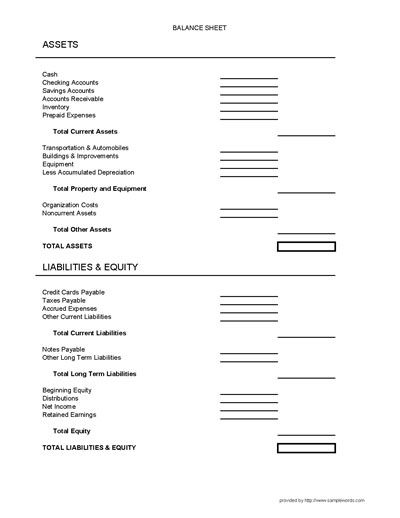

Balance Sheet Form | Balance sheet template, Balance sheet, Small

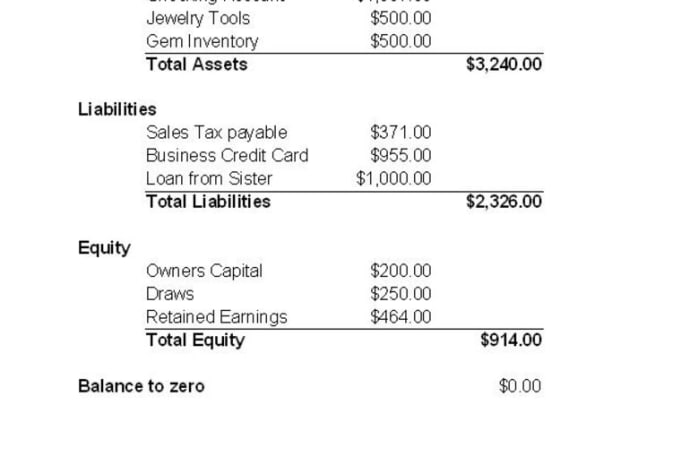

Create a balance sheet for your small business by Hcworks | Fiverr

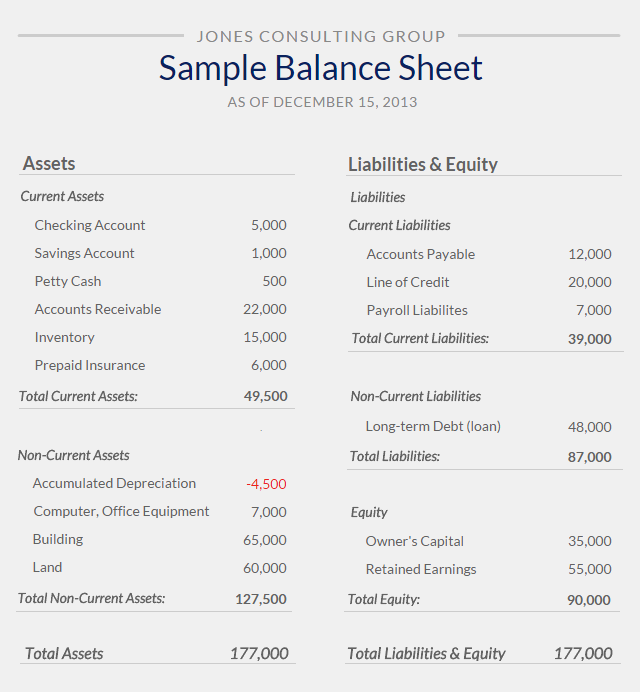

What Is a Balance Sheet? | Bookkeeping business, Small business