Whether trying to mortgage payments or credit card debt, you need to consider some basic things to reduce while writing a letter. Debt payment reduction Letters should convey a decrease in the debt on the part of the letter writer, then a follow an actionable proposal and by, to reflect the commitment.

Accept your debt

The opening of a collection letter can often provide a declaration of understanding the debtor with respect to the debt. This sends a message to a lender that you have done your homework. A call to Capital One Collections department underlined the importance of this point. Ricky D., an agent with Capital One, summarizes: “If I have a letter, which clearly shows that they understand the debt and to understand to get the debts of their responsibility, [it] opens doors, together with them Threatening. , offensive or denying letter, the debt does not function correctly. “letters should start with a realistic statement of debt and its status.

explain the situation

In a letter to write, the debtor has the opportunity to explain why offer become a problem debt. Instead of excuses, explained clearly and directly reasons for the situation may often result in better response johnsinga. Bank of America collections specialist Roza G. says: “We are here to pass people at Bank of America, we understand things It.. is important, as fast as you can, why a debt repayment to be delayed in order to inform us. We can supply many different things to do, for those who are proactive on us. ”

Provide a reasonable solution

Many lenders willing to work with consumers who have debt problems to work. If a debt without extensive collection methods are settled, the lender may savings to consumers to pass One way to show a serious approach to solving a debt, it is a solution to offer. Explain the situation and offer reduced payments to make, until the situation happened. Miracles to expect from the lender but is wrong. While perhaps to bring a well-crafted letter a point or two reduction or an extended period, begging for immediate forgiveness of debt is less likely to succeed.

Keep the Committment

After writing a letter, keep a copy and include it with any correspondence with the lender. Also keeping obligations set out in the letter is critical to success. Those who can not comply with an obligation to pay a debt, even at negotiated rates, consolation may need in other resources, such as Consumer Credit Counseling Service-type of organization to look.

resources

Consumer Credit Counseling Agencies

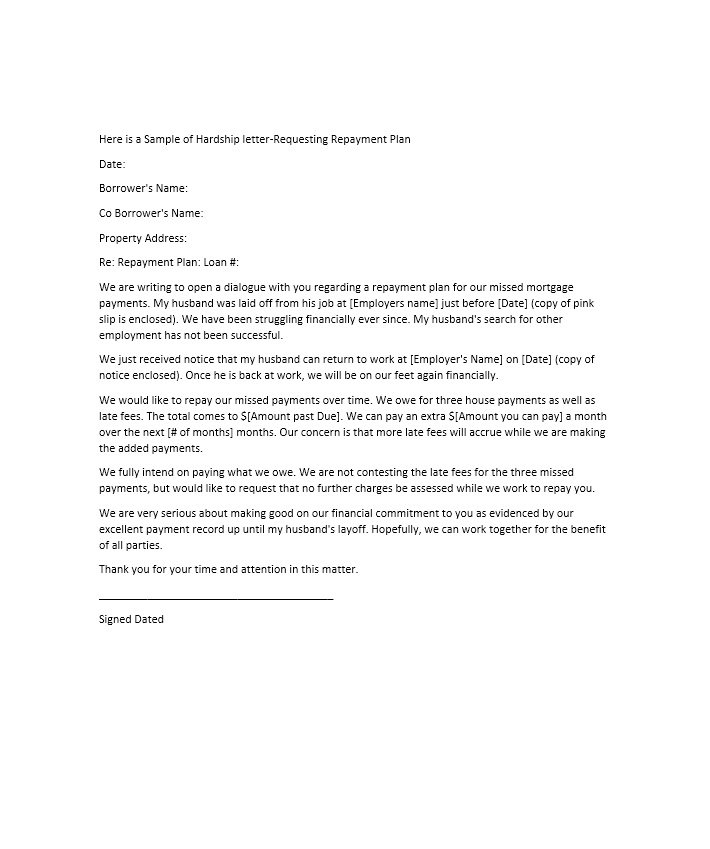

Free Hardship Letter Template | Sample Mortgage Hardship Letter

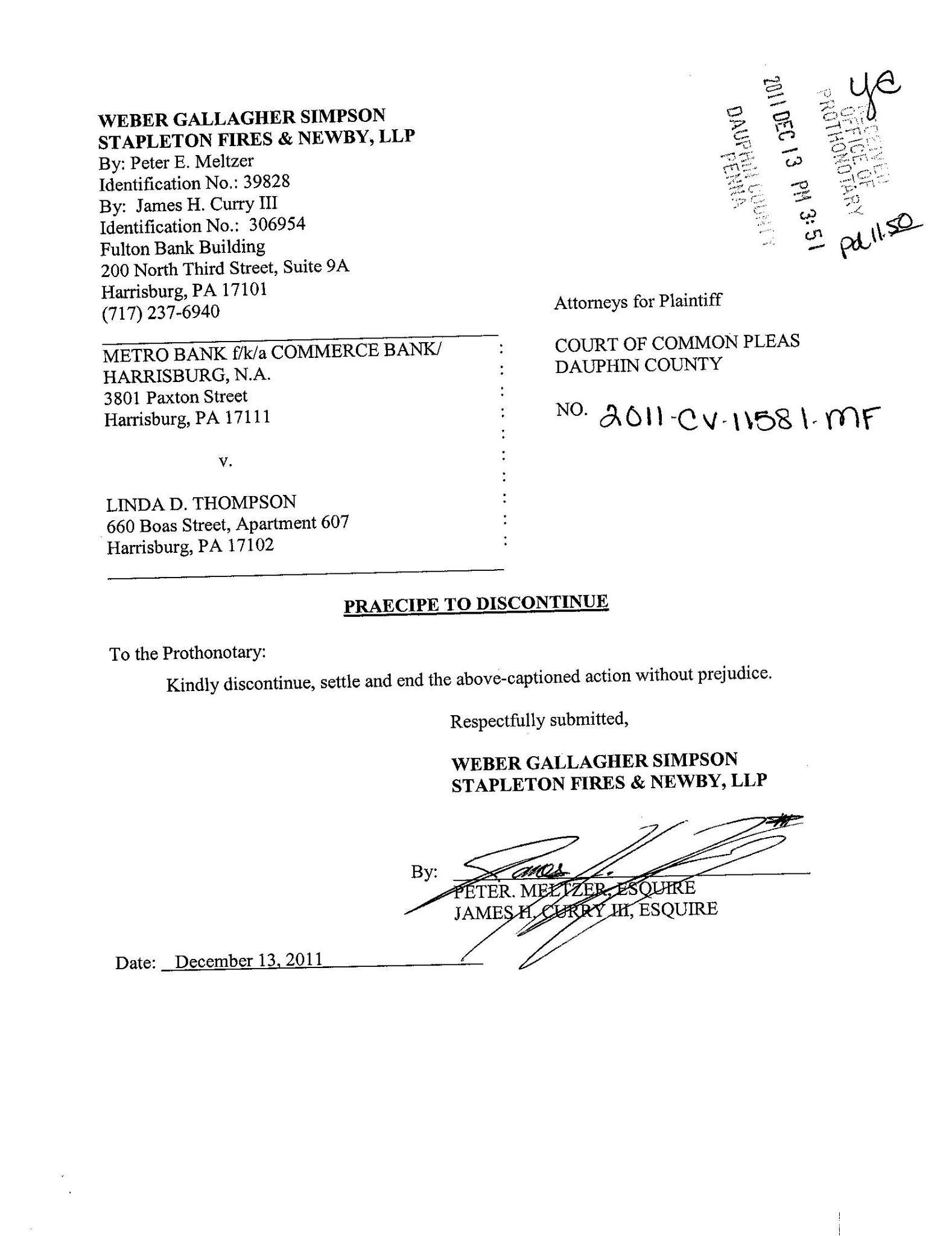

Harrisburg Mayor Linda Thompson pays late taxes, mortgage payments

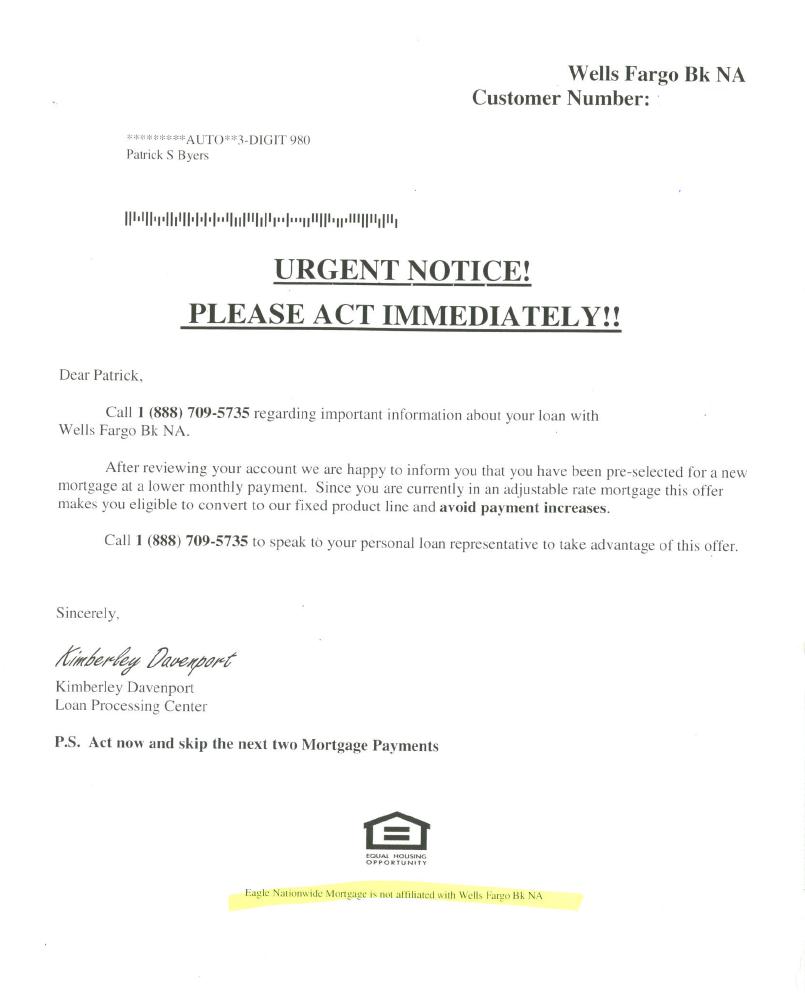

Hall of Shame: Misleading mortgage marketers Outsource Marketing

Mortgage Payment Shock Letter Template Collection | Letter Cover

Sample Letter of Financial Hardship Mortgage Sample, Example

Mortgage Payment Shock Letter Template and Example and Template

35 Simple Hardship Letters (Financial, for Mortgage, for Immigration)

12+ Loan Payment Schedule Templates Free Word, Excel, PDF Format