Payroll accountants play a key role in all companies with one staff. A payroll accountant is, as the name implies, primarily responsible for fulfilling the obligations associated with payroll. Payroll accountants must be familiar with the Federal Insurance Contribution Act (FICA tax), as it is commonly called. The lead accountant in payroll is involved in leading a group of payroll accountants to make sure the team is working properly. In most organizations, the lead accountant responsible for payroll will also be required to provide a smooth payroll process to the workforce of the company. Accounting is a fairly broad term, covering many different types of jobs and duties.

Wage and salary specialists are essentially financial workers, so you want to emphasize your ability to manage money. If you want to become a Payroll Specialist, you need to prove your CV that you have a strong sense of responsibility and the skills necessary to ensure that all employees are paid on time and in full. In most cases, payroll professionals receive a four-year degree in accounting and also a bit more education in business and finance. Our payroll specialist offers templates that help you organize your information optimally.

With a little preparation, you will finally be ready to face the neighborhood labor market head-on. When writing your CV, it is important to consider the payroll sector. So, if the hiring company has not provided salary for work, we look at salary data from related companies and locations to think of a reasonable estimate of what you can expect.

If you want to boost or target your career, you have to choose a path. This job requires the employee to spend long intervals on a computer. If you’re trying to get a job that’s out of your current specialty, you’d like to target your resume to prove to the recruitment manager that you have the skills to get the job done. Never give the main reason why you left your previous job. Most of their work is done internally, and compliance with several government standards and policies is crucial. The work is usually not physically demanding, although it often requires long hours on computers. When it comes to writing a CV, you should always be honest.

The salary depends first and foremost on the position, title and duties of the accountant. The employee has to be mobile. He must be able to occasionally lift or move up to 10 pounds. Both large and small employers in almost every market need payroll specialists to pay for their teams. Instead of merely listing general work duties, the applicant is sure to describe the services in astonishing detail. Applicants wishing to work in larger companies want to have a resident’s accountancy record on their CVs, along with a few years of experience with a more compact business and a background in working with payroll computer software programs. The only requirement is that these documents are accessible.

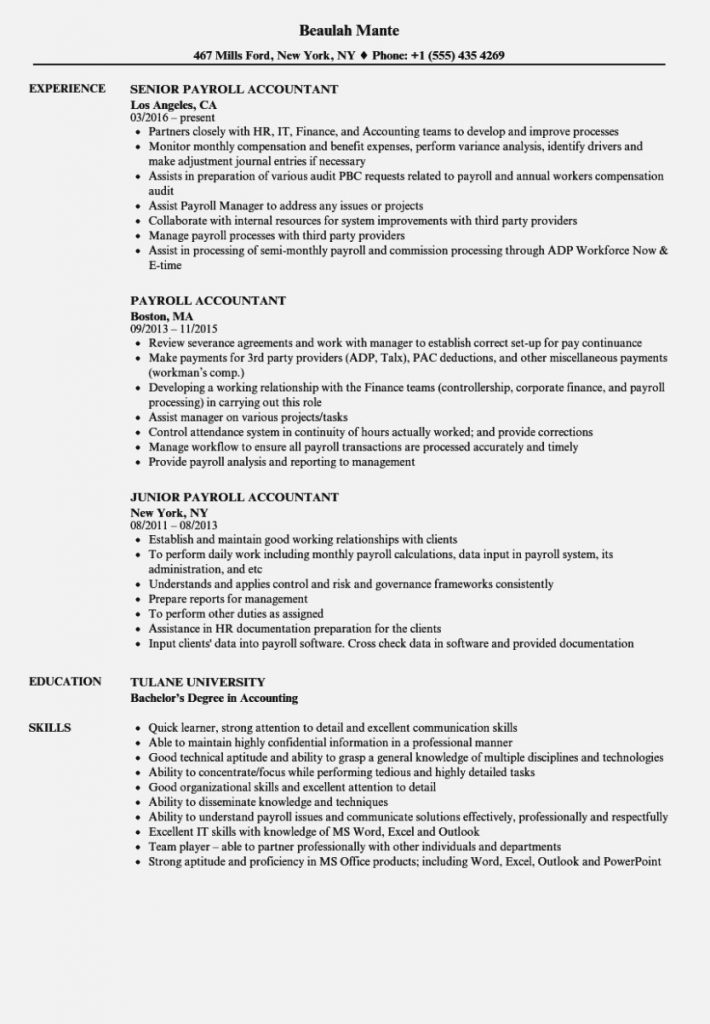

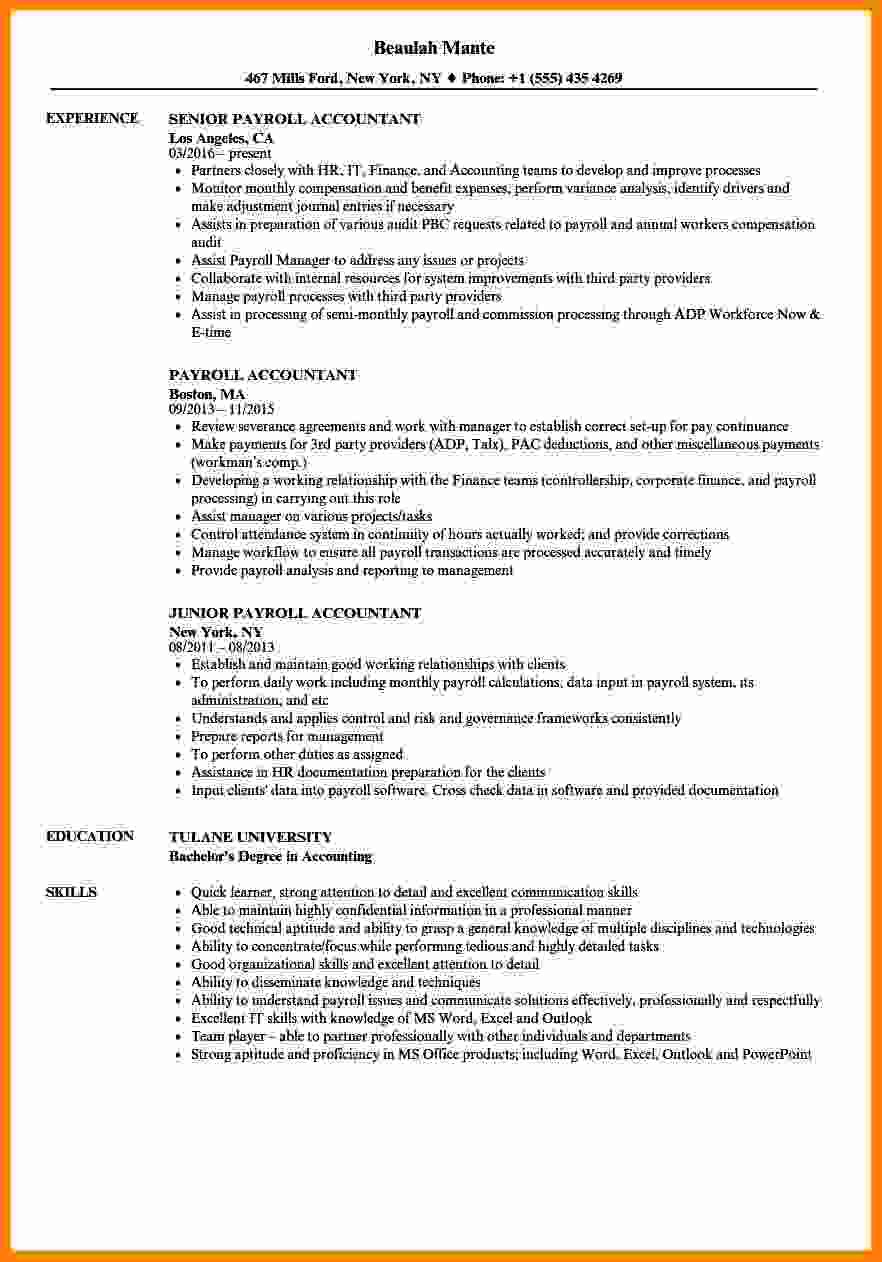

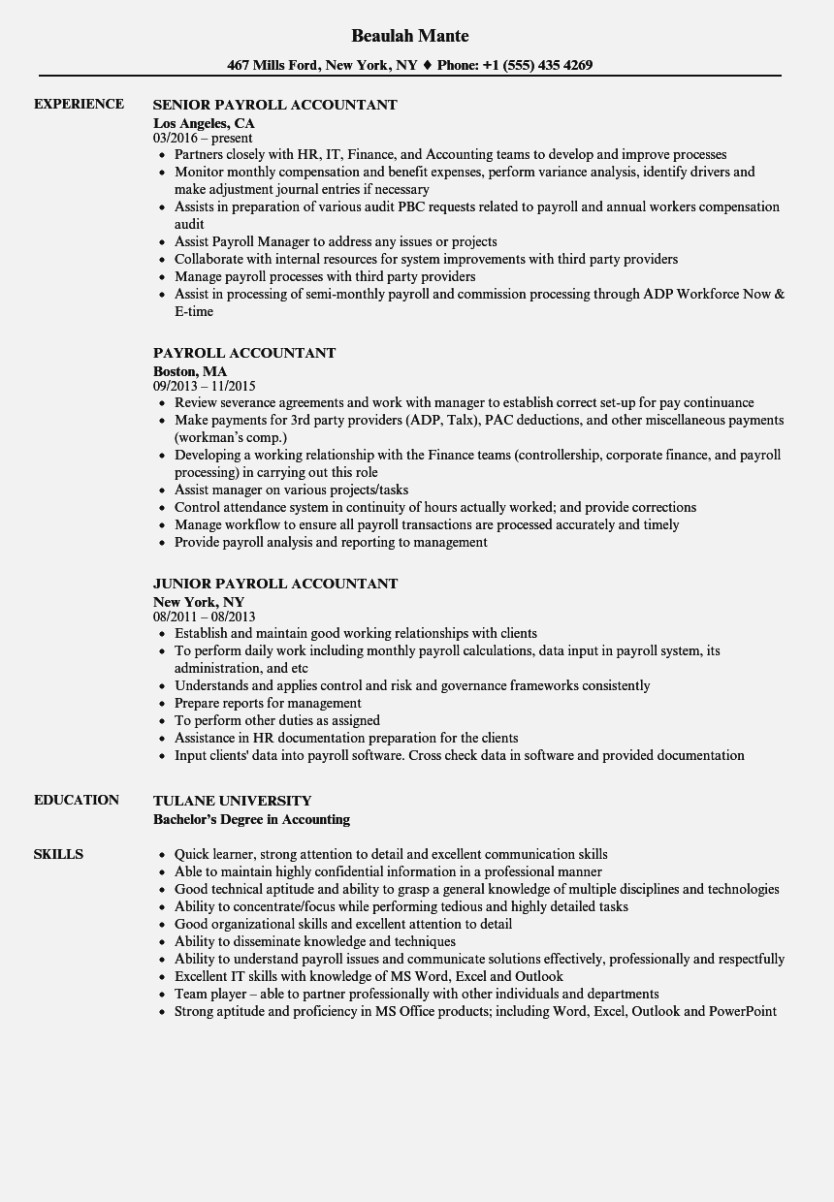

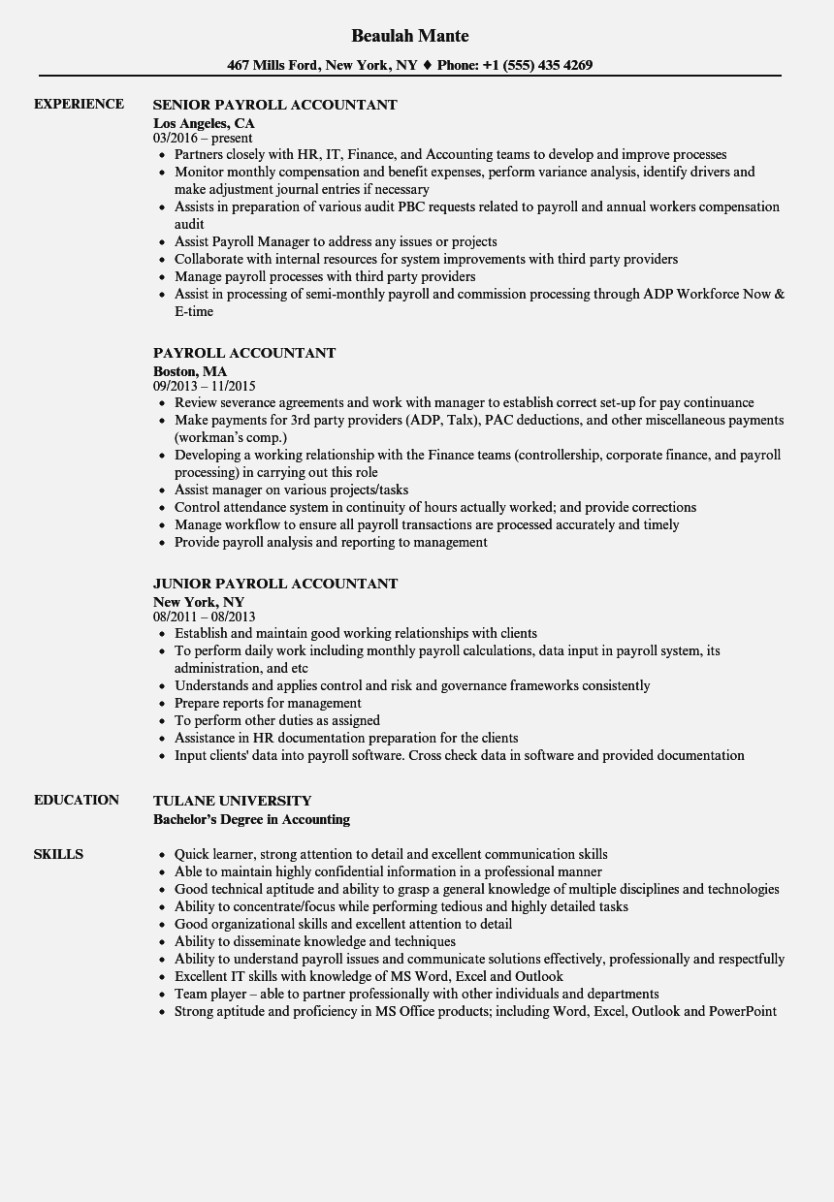

Payroll Accountant Resume Samples | Velvet Jobs

Education Essay: Help Write My Papwer team experts with verified

Payroll Accounting Resume Samples | Velvet Jobs

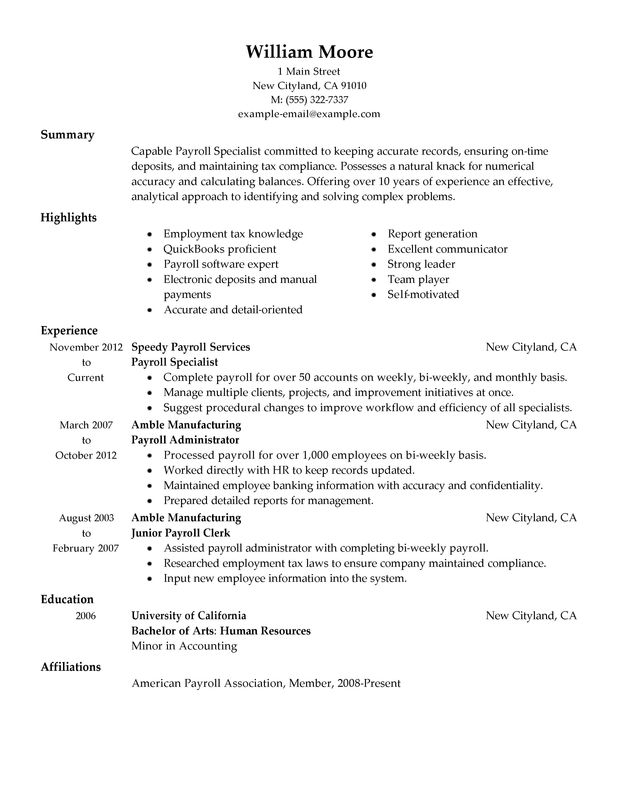

Payroll Specialist Resume Examples Created by Pros | MyPerfectResume

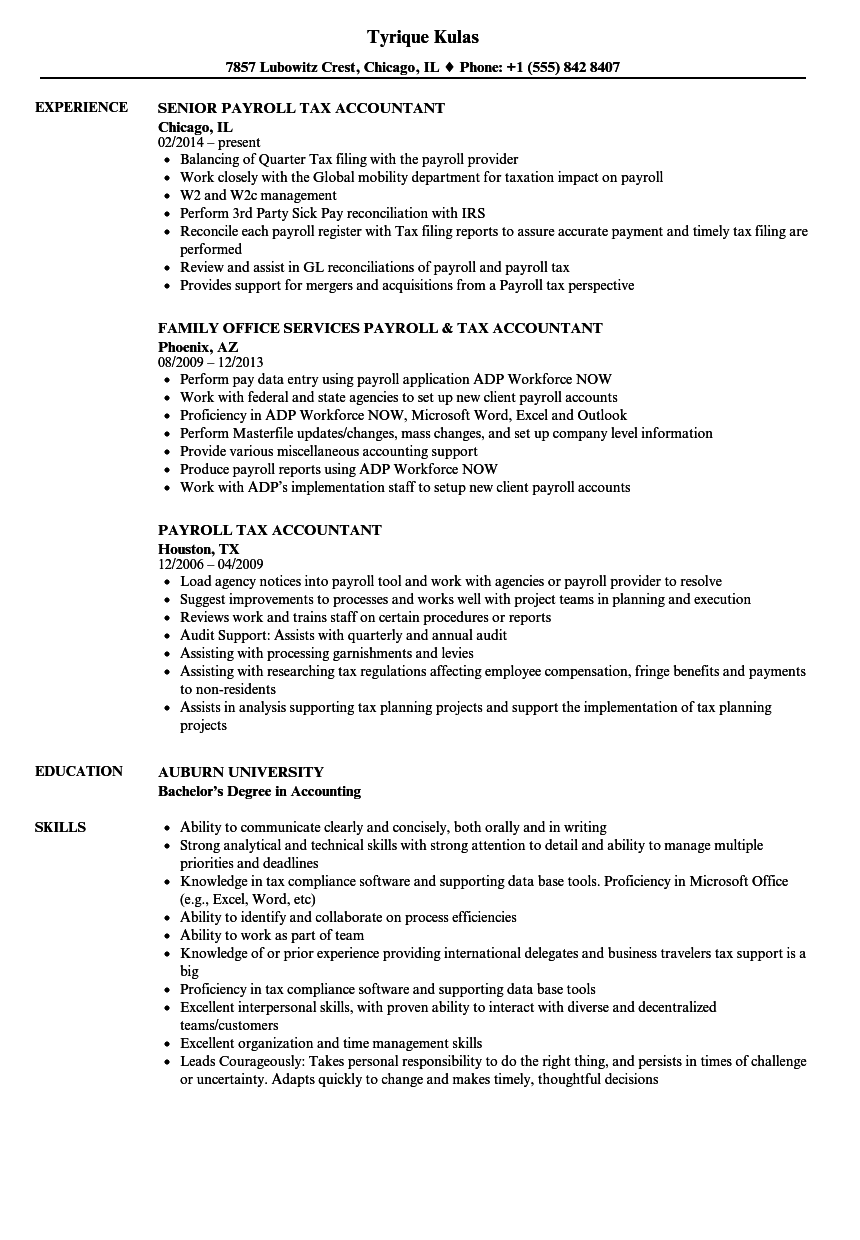

Payroll Tax Accountant Resume Samples | Velvet Jobs

Senior Payroll Accountant Resume

Tax Accountant Resume | TGAM COVER LETTER

14 Payroll Accounting Job Description Inspirational Interior